As we enter 2026, credit card fraud remains a persistent and evolving threat in our increasingly digital world. Global losses from payment card fraud are projected to exceed $43 billion this year, driven by sophisticated AI-powered scams, data breaches, and card-not-present (CNP) transactions. The Federal Trade Commission (FTC) continues to report hundreds of thousands of identity theft cases annually, with credit card fraud leading the pack.

Recognizing the early warning signs of compromise is crucial for minimizing damage. Most major issuers offer zero-liability protection for unauthorized charges, but quick detection can prevent broader identity theft, credit score damage, and prolonged recovery efforts.

This comprehensive guide details 10 critical signs of credit card fraud that consumers should never ignore in 2026. Drawing from recent cybersecurity reports, FTC data, and industry trends, we explore each sign in depth, explain why it occurs, and provide actionable steps for response. Important disclaimer: This information is for educational and preventive purposes only. Always report suspected fraud to your issuer and authorities immediately.

1. Unfamiliar or Unauthorized Charges on Your Statement

The most common and immediate sign of fraud is spotting transactions you don’t recognize. These can range from large purchases to small “test” charges of $1–$10 that fraudsters use to verify card validity before bigger spends.

In 2026, AI automation allows criminals to rapidly test stolen data, leading to quick escalation. According to recent reports, small authorizations often precede major fraudulent activity.

What to do: Review statements daily via your issuer’s app. Enable real-time alerts for all transactions. Contact your issuer immediately to dispute charges—federal law limits liability to $50, often waived entirely.

experian.com

newschannel5.com

READ ASLO Understanding Online Credit Card Fraud: Key Risks and Prevention Strategies in 2026

2. Sudden Drop in Available Credit or Unexpected Limits

If your available credit plummets without explanation, fraudsters may have maxed out your card with unseen purchases. This sign often appears before charges hit your statement due to pending authorizations.

High-utilization fraud impacts your credit score quickly. Monitor via app dashboards or free tools.

What to do: Log in immediately to check balances. Report to your issuer for investigation and potential card replacement.

3. Fraud Alerts or Notifications from Your Bank

Your issuer contacts you about suspicious activity—via call, text, email, or app push. In 2026, AI-driven detection flags anomalies like unusual locations or patterns faster than ever.

These alerts are legitimate issuer communications, not scams.

What to do: Respond promptly. Confirm or deny transactions. Beware of follow-up scams impersonating the alert.

4. Missing or Delayed Billing Statements

If statements stop arriving (physical or digital), a fraudster may have changed your contact information to hide activity.

Address changes are a classic account takeover tactic.

What to do: Contact your issuer to verify details. Update to paperless if preferred, but monitor login activity.

ALSO CHECK How Can I Protect My Credit Card from Hackers in 2026? A Comprehensive Guide

5. Unexpected New Cards or Account Changes

Receiving a replacement card you didn’t request, or noticing changes like added authorized users, signals compromise.

Fraudsters sometimes request replacements to intercept mail.

What to do: Alert your issuer immediately. Place a fraud alert on credit reports via Equifax, Experian, or TransUnion.

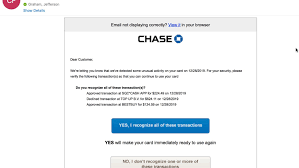

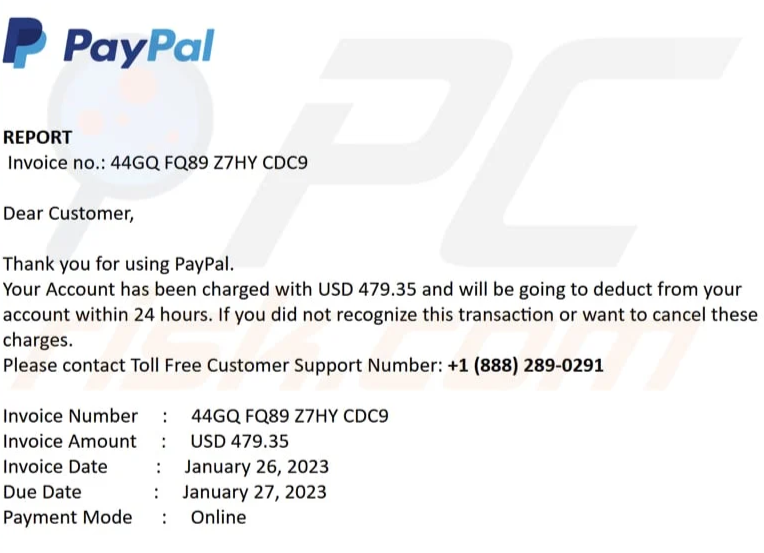

6. Suspicious Emails, Texts, or Calls Requesting Card Details

Phishing attempts posing as your bank, urging “verification” for alleged fraud. In 2026, deepfake voices and AI-generated messages make these hyper-realistic.

These are entry points for data theft.

What to do: Never share details via unsolicited contact. Verify by calling the official number on your card.

usatoday.com

cyberpilot.io

7. Unusual Login Attempts or Account Lockouts

Frequent failed logins or sudden lockouts indicate credential stuffing attacks using breached passwords.

Account takeover fraud rose sharply post-EMV adoption.

What to do: Enable multi-factor authentication (MFA). Use unique passwords and a manager.

8. Hard Inquiries or New Accounts on Your Credit Report

Unexplained inquiries or new cards/loans signal identity theft using your data.

Synthetic identity fraud is a growing 2026 trend.

What to do: Check reports weekly at AnnualCreditReport.com. Place a credit freeze if needed.

9. Declined Transactions Despite Sufficient Credit

Legitimate purchases declined due to fraud flags from prior unauthorized use.

Banks block cards proactively upon detecting compromise.

What to do: Call your issuer—often the first confirmation of issues.

10. Alerts from Credit Monitoring or Dark Web Scans

Notifications of your data on underground markets, or unusual credit activity.

With rising breaches, these services detect exposure early.

What to do: Act on alerts change passwords, freeze accounts, monitor closely.

Why These Signs Matter More in 2026

Fraud has industrialized with “Fraud-as-a-Service” and AI tools enabling deepfakes, automated bots, and synthetic identities. CNP fraud dominates, projected to drive massive losses. Younger adults report higher victimization rates, though seniors face larger average losses.

Early detection limits damage most victims recover fully with prompt action, but delays can lead to prolonged credit issues.

Steps to Take If You Spot These Signs

- Contact your issuer immediately — Report fraud and request card cancellation/replacement.

- Dispute charges — In writing for full protection under the Fair Credit Billing Act.

- Change passwords and enable MFA — Across all financial accounts.

- Monitor credit reports — Place fraud alerts or freezes.

- Report to authorities — FTC at IdentityTheft.gov and local police.

- Update recurring payments — With new card details.

Preventive Measures for Ongoing Protection

- Use virtual card numbers for online purchases.

- Enable transaction alerts and biometric logins.

- Avoid public Wi-Fi for banking; use VPNs.

- Regularly review accounts and reports.

- Consider identity theft protection services.

By staying vigilant and recognizing these 10 signs, you can significantly reduce fraud risks in 2026’s challenging landscape. Financial security starts with awareness—review your accounts today.